UAE remains a gateway to global businesses and provides opportunities for growth and expansion. We are firm of professionals who extend the required assistance and handholding in these rapidly changing times to suit the needs of your business in areas of tax, accounting and regulatory aspects.

Overview Of UAE Tax

In January 2022, the UAE government announced the introduction of a federal corporate tax. The standard corporate tax rate will be 9% for businesses that have a net annual profit of or over AED 375,000 and a rate of 0% for businesses with net annual profits under AED 375,000. The announcement included a corporate tax rate of 15% for multinational companies with profits over 750 million Euros a year, which is in line with the Global minimum corporate tax rate agreement.

Freezone businesses can get exempt from corporate tax as long as they do not do business with the UAE mainland and follow other UAE guidelines. The country aims to commence the implementation of the corporate tax regimen starting 01 June 2023. Mainland companies also have to pay a percentage of their revenue to a local company, depending on the areas they are in. There are also sin taxes on alcohol, energy drinks, vapes, and cigarettes in the UAE.

Regulatory Landscape

Proposed Tax Rates

- Effective 1st June 2023, the businesses in UAE will be subject to a Corporate Tax

- Income in excess of AED 375,000 will be subject to 9% Corporate Tax

- Separate provisions for large MNEs where the tax rate will be equalized to 15% as proposed under the BEPS 2.0

Prepare for tomorrow

- Matching of books and financials

- Records submitted underVAT, ESR, Corporate Tax should be aligned

- Audit (could be mandated with a threshold)

- Brought forward / carry forward of losses

- Assessing the formation of Group for tax purposes

Questions in your mind

- Transactions within the UAE could also be covered

- Scarcity of comparable and reliable data

- ALP of management fees and salaries paid to owners

- Interest free loans

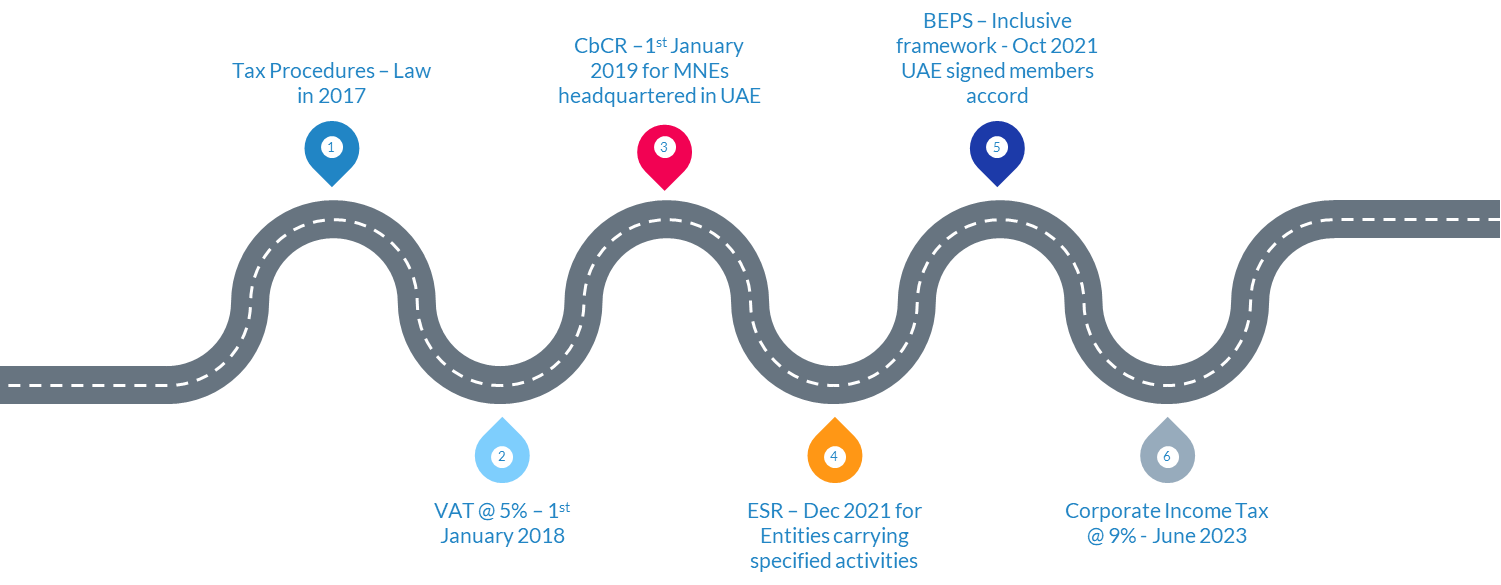

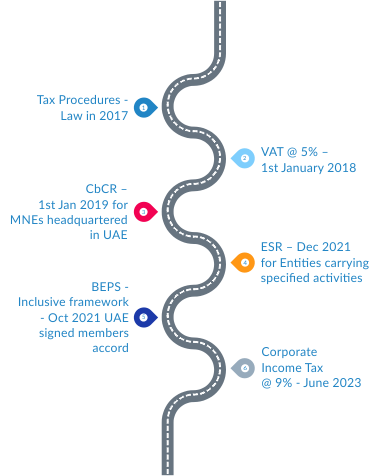

Regulatory Milestones

yourCFO – UAE Capabilities

Accounting and Financial Statements

- CFO Services

- IFRS Advisory and Implementation

- MIS and Dashboards

- Cash-flow, Budget, Forecasts

- Backlog Accounting - Tally, Quickbooks, Zoho, Xero

- HRMS solutions under SaaS model

Tax and Regulatory

- UAE VAT - Advisory, Compliance, and Representation

- Corporate Taxation - Advisory and Implementation

- Cross-Border tax - Advisory and BEPS

- Transfer Pricing - Planning Study & Documentation in Local File, Master CbCR

- Economic Substance Regulations

Other Services

- Set-up in the UAE and other jurisdictions

- Financial modelling and business valuations

- Internal audit & process consulting

- Family office and trust set up advisory

- Technology enabled automation

- Devising SOP's in finance & accounts and operations

About yourCFO

yourCFO is a management consulting firm in operation since 2013. yourCFO believes in the motto of “partnering your growth”. Our team of professionals undertake a thorough diagnostic analysis of your business to assist you walking up the success ladder.

Connect with our Specialists

Umang Someshwar

Partner, UAE and Global Operations

Chirag

Jain

Founder and Partner

Ankit

Raipuria

Partner, Co-founder yourCFO Group

Basnt

Kapoor

Senior Advisor